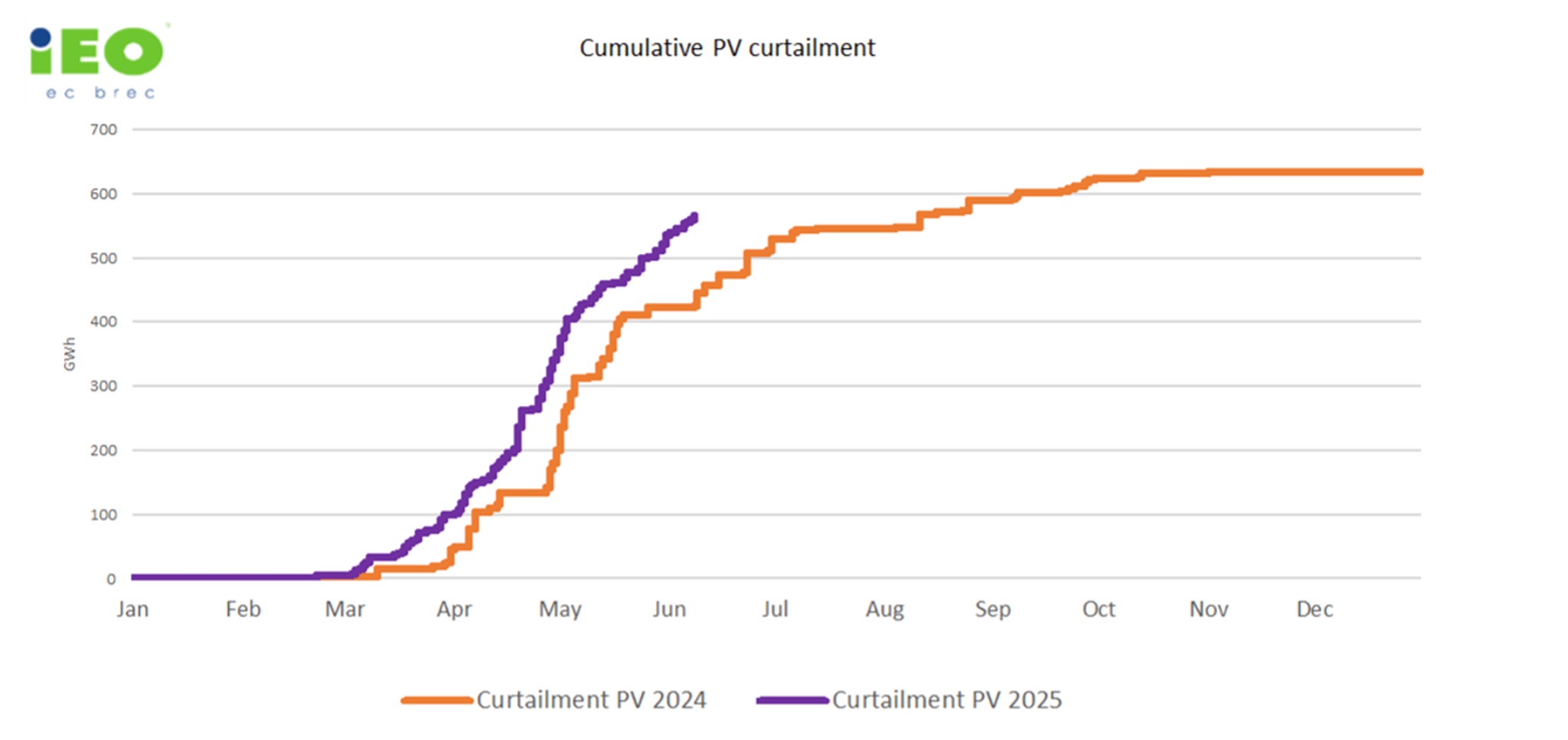

Solar curtailment is on the rise in Poland, with around 600 GWh of PV capacity reduced during the first six months of 2025. The Warsaw-based Institute for Renewable Energy (IEO) suggests one solution is to support the electrification of Poland’s heating sector with the surplus of PV power.

The Institute for Renewable Energy's (IEO) Photovoltaic market in Poland 2025 highlights the growth in curtailment of photovoltaics in Poland. During the first six months of 2025, the transmission system operator (TSO) reduced around 600 GWh of PV capacity. When compared to the first six months of 2024, this represents an increase of nearly 34%. This is a clear signal that the scale of the problem is not only becoming permanent but may soon double if systemic mechanisms for absorbing excess energy are not introduced.

IEO's latest annual report features the telling subtitle ‘Photovoltaics in the electricity and heat market', with the aim of pointing out the urgent need to combine the development of the PV and heating sectors as a flexible consumer of solar energy. The growing importance of green electrification – especially in the heating and industrial sectors – is undoubtedly an opportunity for the entire sector. The use of both PV and wind energy to power electrode boilers (system heat) and heat pumps (heating), as well as storing it in heat storage systems or industrial products (increased production with low energy prices during PV generation peaks) can significantly increase the demand for solar energy and improve system balancing.

The first opportunity to address this topic was in the IEO's Roadmap for the Heat Storage Market report, created in cooperation with the Polish Chamber of Energy Storage in 2024. The topic has gained the attention of Poland's minister for environment, the Polish Power Grid Company and leading district heating and energy management companies. The issue of promoting heat storage capable of absorbing energy from renewable energy sources in Poland has also been reported by the Economic Chamber of Polish Heat Engineering for several years now. The topic is taken up from a slightly different perspective by the Polish Chamber of Commerce (Committee for Energy and Climate Policy). But only recently has the topic caught the interest of weather-dependent renewable energy power generators.

The most important discussions on the shape of green electrification of the heating industry are currently taking place in the Ministry of Climate and the Environment’s team for the transformation of the heating industry, which is working on implementing the concept of green electrification into Polish law. Results from the team's work are to be input into Poland's National Energy and Climate Plan (NECP) and the document ‘Strategy for the Transformation of the Heating Industry to 2040', which considers the (green) electrification of the heating industry to be a key pillar of the “strategy” and an element of sector merging in the NECP.

As IEO reported, the installed capacity of electric sources to work for green electrification after 2025 follows the planned capacity of non-prosumer photovoltaic sources, reaching 23.4 GW in 2035 and 45 GW in 2040. The level of district heating electrification is expected to grow from 23% in 2025, through to 46% in 2030, and up to 82% in 2040.

The EU Clean Industrial Deal of Jul. 2, 2025, set two measurable targets. First, an annual increase of 100 GW in renewable energy capacity by 2030 (between 2023 and 2024, the EU27 would add 68 GW and 70 GW of total wind and solar capacity, respectively, or an average of 98.4% of all new renewables capacity), and second, an increase in the electrification rate in the economy, including heating, from the present 21.3% to 32% in 2030 (renewable energy sources-only electrification). As part of this “pact”, the European Commission has pledged to develop a detailed Electrification Action Plan (by the first quarter of 2026) and a Heating and Cooling Strategy (also by the first quarter of 2026), which will further support the goals of renewable energy-based electrification, sector integration and increased flexibility of district heating systems.

Making full use of available generation at hours with low energy prices is key to further transforming the heating and power industry and providing security for investors in renewable energy sources. In 2024, there were 4,496 hours where the price for heat from district heating systems (capacity 55 GW) was about PLN 430 ($117.14)/MWh, higher than the price of electricity, which had an average spot market energy price of PLN 414/MWh. This confirms the enormous opportunities for cooperation between the renewable energy sector and the heating industry.

So far, the biggest problem in sector coupling, green electrification and development of power purchase agreements between weather-dependent renewable power generators and flexible heat plants is the high cost of electricity distribution. To trigger power-to-heat technology and mitigate renewables curtailment, IEO proposes a regulation with partial exemption from distribution and grid fees within hours indicated by TSO as “energy surplus” in the grid (up to 20% of the hours in a year). Under the regulation, an entity authorized to purchase surplus electricity will be able to take advantage of reduced distribution fees, including not incurring a power fee, a fixed fee and a cogeneration fee. This would significantly make this type of energy more attractive during “surplus hours” of renewable energy subjected otherwise to curtailment.